Home Fitness - How is it working out?

The COVID-19 Pandemic has us doing more from our homes than ever before. Apartments, cottages, and houses have turned into bakeries, offices, and gyms. The fitness industry experienced significant changes in the past year, with some fitness segments emerging unscathed while some others got hit hard and are trying to figure out how to best cope with the new reality.

In person fitness shattered

About 15% of gyms, health clubs and studios had closed permanently through Q3, 2020 and as many as 25% may have closed by the end of 2020 (IHRSA, November 2020). Virtually all that remain in business have some limitations on their operations. As a result, fitness enthusiasts were forced to find new ways to work out. To the detriment of gyms, research indicates that both new and seasoned athletes are enjoying their home-based workouts enough to not rejoin their gyms after the COVID-19 pandemic [TD Ameritrade, 2020].

Digital fitness makes a splash

Americans are enjoying their living rooms in new and different ways with a little help from home fitness apps. Global downloads of fitness apps grew by 46% [Visual Capitalist] in just the first 2 quarters of 2020! The void left by in-person fitness has pushed us to do things we would not have previously considered, like accessing virtual fitness content and live streaming fitness classes. Based on research conducted by Mindbody, the most popular virtual bookings were for yoga followed by HIIT and Pilates.

And then there is Peloton – one of this industry’s biggest success stories. As of Q4 2020, Peloton’s fitness subscriptions grew 113% and Peloton boasts membership grew to approximately 3.1 million.

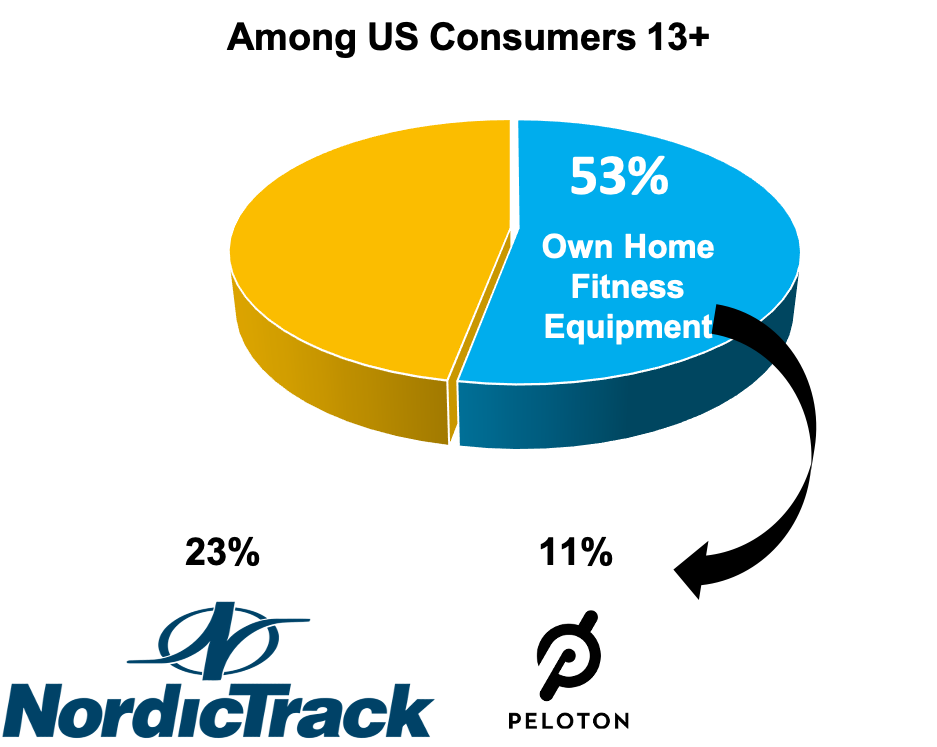

Based on Lab42 2021 research among US consumers 13+, more than one in four (28%) have streamed a workout in the past 3 months and more than half (53%) own some type of home fitness equipment, with 11% of those owning a Peloton (bike or treadmill). Not bad for a brand that started selling to consumers in 2014 and has an average price of almost $2k for a bike and $4k for a treadmill, plus monthly subscription fees.

Despite Peloton’s meteoric rise, NordicTrack still has the lion’s share in home fitness with 23% ownership. NordicTrack, however, is not generating quite as much interest as Peloton. According to Google trends, Peloton has generated about 5 times more online searches vs. NordicTrack in the past year.

What do we know about Peloton owners?

Our data shows that Peloton owners tend to skew toward young, urban white couples, with high household incomes.

They may be more into fitness as on average they own more fitness equipment in their home (2.1 pieces of equipment compared to 1.6 for all home fitness equipment owners)

They tend to stream a variety of workouts with yoga and weightlifting as the most popular.

Peloton users are not as likely to step away from their Pelotons post COVID. On the contrary, almost half (49%) say they will stream more at home workouts in the future (compared to just 35% of total fitness streamers).

Peloton definitely has momentum and it is propelled in part by its media buzz. However, the category is dynamic and newer entrants like Mirror, Tempo or Tonal, though relatively small right now, are pushing the category even further into the digital realm. How gyms adapt to the new realities of COVID and the developing technologies and how consumers react to the changes is still unknown, making fitness an exciting category to follow.